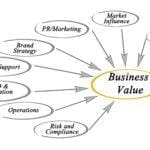

Why have a Profession Business Appraisal or Valuation? Know the Economic Value of Your Business- Your Largest Asset A business appraisal determines the current value of a business based on its team, assets, intellectual properties, earnings, growth, and losses, usually during a financing event. Regardless of the reason, every small business owner should consider conducting […]

Determining Your Business’s Market Value

Business Valuation Articles

How do you calculate business value?

Determining the market value of a private company can be complex and depends on various factors such as financial performance, industry trends, growth potential, and comparable company valuations.

Business Valuation Methods

One common method used to estimate the market value of a private company is the multiples approach. This approach involves analyzing the financial performance of similar publicly traded companies and applying a multiple (such as price-to-earnings or price-to-sales) to the private company's financial metrics, such as revenue or earnings.

Another approach is the discounted cash flow (DCF) method, which involves projecting the future cash flows of the company and discounting them back to their present value. This method takes into account the time value of money and the perceived risk associated with the company's future cash flows.

Why Use a Business Valuation Firm

Additionally, engaging with a professional business valuation firm or investment banker can provide a more accurate assessment of a private company's market value. These experts have the knowledge and experience to analyze the company's financials, industry dynamics, and market conditions to determine a fair valuation.

It's important to note that market value can vary depending on the purpose of the valuation (e.g., sale, investment, or internal planning) and the specific circumstances surrounding the company.

Ultimately, estimating the market value of a private company requires a comprehensive analysis and consideration of various factors. It is recommended to consult with professionals in the field to obtain an accurate valuation.

Business Appraisal FL|GA|HI hopes you enjoy our articles on business valuations.

Five Ways to Maximize the Value You Receive from a Business Valuation

The Value of a Business Valuation When you consider hiring a specialist with business valuation or business appraisal experience, what else can you receive from your investment in a business valuation? Like most business owners, you see the bottom line: Your company’s value number. Nevertheless, there is so much more value a certified business valuation […]

Buying a Small Business? What You Need to Know.

How to Value a Business for Sale Know Your Target Business’s Value, Risk, and Pitfalls Sorting through the 100,000+ businesses for sale as a business owner Use a 3rd Party Business Valuation when Buying a Business Owning and operating a small business can be extremely rewarding. For some, doing so represents the opportunity to create […]

Business Valuation for Buy-Sell Agreements

How to Value a Company for Buy-Sell Agreements Buy-Sell Agreements for Closely Held Companies and Their Value As a business owner, you know the importance of a buy-sell agreement. Business owners execute these contracts with each other. They establish the guidelines that allow for exits, shareholding, and funding for purchases. Certain events trigger the need […]

How to Value a Small Business

What is a Small Business Appraisal? Why do small business owners need to know the market value of their business? Knowing the True Worth of Your Small Business or Valuing a Small Business for Sale As a small business owner, you are intimately familiar with how rewarding owning a small business can be. When your […]

What You Need to Know about the IRS Business Valuation Guidelines

Business Valuation for Gift and Estate Taxes Certified Business Valuation for IRS Purposes How do you value a business for estate tax purposes? All businesses eventually require a business appraisal to determine their current economic value. Such valuations are often conducted at the onset of a financing or tax event within the business lifecycle. The […]

The Complete Guide on How to Choose the Best Business Appraiser

Who is the Best Valuation Company for Your Engagement? There are many reasons to hire a business appraiser other than an owner wanting to sell their company or someone wanting to make an offer to buy. If a company wants to raise equity, it’ll need a valuation to determine its worth. Employee incentive planning, taxes, […]

Is your private company issuing stock options? The need for an IRC section 409a Valuation

The enterprise value of a private company How do you Value Private Companies? What is a 409A Private Company Valuation? How do I get a 409a Appraisal? Do I need a 409A Valuation? If your private company is issuing stock options or any other form of deferred compensation or equity compensation to your employees, you […]

What is a business valuation firm?

How to choose the right business valuation firm Operating a business can be extremely rewarding. For some, it represents an opportunity to build wealth when you sell your business. It might be a trial of leadership for your family. For many, it is a chance to build a legacy for generations to follow. Do you […]

A Local Nashville, TN Business Appraisal Company

Understand the Value of Your Tennessee Business A Local Nashville Business Valuation Firm Knowing the true value of your business will support and guide you through the various financial events you will encounter during your Tennessee company’s business lifecycle. Your Tennessee business is worth so much more than the raw numbers on your balance sheet—but […]

Kentucky Business Valuation Services

Business Appraisal Kentucky Services 502-805-0181 Valuing Your Kentucky Business Kentucky Business Appraisal Services Are you seeking professional business appraisal services in Kentucky? Whether you are buying, selling, merging, or planning for your business, a certified business valuation will provide your Kentucky business with your company’s true value. At Business Appraisal FL|GA|HI, we have the expertise […]

Ohio Business Valuation Services

Business Appraisal Ohio Services How to Value Your Ohio Business Ohio Business Appraisal Services What do Ohio business owners do when seeking a professional and legitimate business valuation? If this is you, your search ends here. Whether you are buying, selling, merging, or planning for your Ohio business, understanding the true worth of your company […]