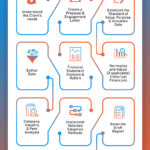

The Valuation Business Steps to Determine the Value of a Company What is Business Valuation? Business valuation is the process of determining the economic value of a business. It’s a crucial step for business owners, investors, and stakeholders to understand the worth of a company. Business valuation involves analyzing various aspects of a business, including […]

Determining Your Business’s Market Value

Business Valuation Articles

How do you calculate business value?

Determining the market value of a private company can be complex and depends on various factors such as financial performance, industry trends, growth potential, and comparable company valuations.

Business Valuation Methods

One common method used to estimate the market value of a private company is the multiples approach. This approach involves analyzing the financial performance of similar publicly traded companies and applying a multiple (such as price-to-earnings or price-to-sales) to the private company's financial metrics, such as revenue or earnings.

Another approach is the discounted cash flow (DCF) method, which involves projecting the future cash flows of the company and discounting them back to their present value. This method takes into account the time value of money and the perceived risk associated with the company's future cash flows.

Why Use a Business Valuation Firm

Additionally, engaging with a professional business valuation firm or investment banker can provide a more accurate assessment of a private company's market value. These experts have the knowledge and experience to analyze the company's financials, industry dynamics, and market conditions to determine a fair valuation.

It's important to note that market value can vary depending on the purpose of the valuation (e.g., sale, investment, or internal planning) and the specific circumstances surrounding the company.

Ultimately, estimating the market value of a private company requires a comprehensive analysis and consideration of various factors. It is recommended to consult with professionals in the field to obtain an accurate valuation.

Business Appraisal FL|GA|HI hopes you enjoy our articles on business valuations.

How To Determine the Value of Your Florida Business

Value My Business For most business owners, the goal of starting and running a business in Florida is to operate your own company and (of course) make a net profit. However, as time progresses, entrepreneurs agree that the goal of the company is to generate value through the goods or services it offers. So, by […]

The Difference Between a Business Valuation, Business Evaluation, and a Business Appraisal

Business Appraisal vs Evaluation vs Valuation The distinction between valuation and evaluation as nouns is that valuation is an estimate of an object’s worth. In contrast, evaluation is an appraisal of a situation or person. This can be an annual staff performance analysis for a pay raise or promotion. It could also be a description […]

Business Valuation Trends updated for 2025

Business Appraisal FL|GA|HI (BA FL|GA|HI) stays on top of business valuation trends. The unpredictable 2021 pandemic has changed the valuation of many businesses. BA FL|GA|HI will keep you updated as we monitor the global business valuation environment and report our findings back to you. As a business owner, you are fully aware of the key […]

R&D Tax Credit FAQ

Qualifying for R&D Tax Credits “The avoidance of taxes is the only intellectual pursuit that carries any reward.” John Maynard Keynes Q: Who qualifies for the R&D Tax Credit? A: One of the common misconceptions about R&D Credit. Companies with teams of scientists in lab coats have this R&D Credit reserved for them. Any company […]

Why Take Advantage of Third-Party Business Appraisal Before Going to Market?

9 Things to Consider When Choosing a Business Valuation Firm It is important for business owners to use a professional valuation service, particularly if they plan to sell their company. If you don’t want to risk losing money by undervaluing your business or pushing away prospective customers because of an overvalued price, then it’s critical […]

What Is a Capitalization Rate? Definition, Formula & Examples

Understanding a Cap Rate in a Business Valuation A capitalization rate, or cap rate, is a key metric in both business valuations and real estate investments that answers the question: what is a capitalization rate? It indicates the rate of return on a business or property based on its net operating income (NOI) and market […]

A Local Nashville, TN Business Appraisal Company

Understand the Value of Your Tennessee Business A Local Nashville Business Valuation Firm Knowing the true value of your business will support and guide you through the various financial events you will encounter during your Tennessee company’s business lifecycle. Your Tennessee business is worth so much more than the raw numbers on your balance sheet—but […]

What You Need to Know about the IRS Business Valuation Guidelines

Business Valuation for Gift and Estate Taxes Certified Business Valuation for IRS Purposes How do you value a business for estate tax purposes? All businesses eventually require a business appraisal to determine their current economic value. Businesses often conduct such valuations at the onset of a financing or tax event within the business lifecycle. The […]

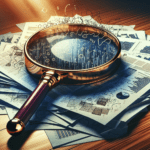

How a Quality of Earnings Report Enhances Financial Clarity

What is a Quality of Earnings Analysis? What can a quality of earnings report reveal about a company’s true financial health? Designed to offer a clear picture, it sifts through earnings to highlight sustainable and achievable earnings, free from accounting distortions or non-recurring events. This article will guide you through the critical role these reports […]

Mastering Going Concern Value: Essential Insights for Business Valuation

Going Concern Business Valuation Methods Going concern value reflects a business’s worth, assuming it continues operations indefinitely. It factors in both tangible assets and intangible elements like brand reputation and customer relationships. Understanding this concept is essential for accurate business valuation. This article explores the going concern value, its importance, and the methods used to […]

Navigating Interest Rates and Business Value for Success

Interest rate effects on valuation multiples How do interest rates and business value impact each other? Understanding this can help you make better investment decisions. This article explains the key effects of interest rates and business value on business valuation and offers strategies for navigating these changes. You can also read how inflation destroys business […]