Review an Example Business Valuation In this article, we’ll guide you through examples of a fair market value company valuation, utilizing techniques such as the Discounted Cash Flow (DCF), Total market value, and Earnings Multiplier methods. We will show you how we select the appropriate method for a company’s valuation, collect essential data, and carry […]

Transactions

Valuations for Business Transactions

Once upon a time, in the bustling world of business, there was a business valuation company called Business Appraisal FL|GA|HI. Business Appraisal FL|GA|HI was known everywhere for its expertise in business valuations, particularly for those looking to sell or acquire a business. They had a team of experienced professionals who could unravel the complexities of financial statements, market trends, and industry analysis to determine the true worth of a company.

A Business Valuation as Part of Your Exit Strategy

Valuations for M&A Transactions

In this fast-paced world of mergers, acquisitions, and business transactions, Business Appraisal FL|GA|HI understood the importance of accurate and reliable valuations. They knew that the key to a successful sale or acquisition lay in understanding the true value of a business. That's why they dedicated themselves to providing comprehensive and insightful valuations that would empower their clients to make informed decisions.

Business Valuation Consultants

But Business Appraisal FL|GA|HI didn't stop at just crunching numbers. They believed in building relationships with their clients, understanding their unique needs and goals, and tailoring their valuations to suit each situation. They knew that every business had its own story, its own strengths, and weaknesses, and they strived to capture the essence of these qualities in their valuations.

Valuations for Transactions Articles

On our blog, Business Appraisal FL|GA|HI aimed to share their expertise and insights with business owners, entrepreneurs, and investors who were navigating the world of business valuations. They knew that understanding the process and the factors that influenced a business's value was essential for making sound decisions. Through their blog, they wanted to demystify the world of business valuations, providing practical tips, case studies, and industry updates to help their readers navigate the complexities of valuing a business.

Why Business Appraisal FL|GA|HI

So, whether you were a business owner looking to sell your company, an investor considering an acquisition, or simply someone curious about the world of business valuations, Business Appraisal FL|GA|HI's blog was the place to be. Join them on their journey as they unravel the mysteries of business valuations and empower their readers to make confident and informed decisions in the ever-evolving world of business.

Mastering Net Working Capital in Mergers and Acquisitions Deals

What is Net Working Capital in M&A Deals? In mergers and acquisitions (M&A), net working capital (NWC) in M&A acquisitions determines if the received business can continue operating smoothly post-transaction. Buyers use NWC to gauge a company’s short-term financial health and set accurate purchase prices. This article delves into net working capital’s role in M&A, […]

How to Buy into a Business: A Step-by-Step Guide

Safely Buying into an Existing Business as part of Partnerships Buying into an existing business involves key steps and essential research. This guide explains how to buy into an established company, covering management roles, financial evaluations, and securing financing. Follow these steps to protect your principal, make informed decisions, and transition smoothly into business ownership. […]

Successfully Merging with Competing Companies: A Strategic Guide

What is a Horizontal Merger? Merging with a competing company can significantly impact your business. This guide explains how you can use these competition mergers to increase market share, enhance efficiency, and achieve strategic growth. Key Takeaways Understanding Mergers with Competitors A merger is a strategic decision to combine two or more companies into a […]

What Is a Capitalization Rate? Definition, Formula & Examples

Understanding a Cap Rate in a Business Valuation A capitalization rate, or cap rate, is a key metric in both business valuations and real estate investments that answers the question: what is a capitalization rate? It indicates the rate of return on a business or property based on its net operating income (NOI) and market […]

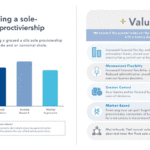

How to Value a Sole Proprietorship: A Comprehensive Guide

Valuing a Small Business for Sale or to Buy Appraising a Sole Proprietorship If you need to know how to value a sole proprietorship, this guide will help. We’ll cover the key factors and methods you need to determine your business’s worth, including analysis of assets and financial documents. By understanding these steps, you can […]

How to Value a Company for Investors

Valuing a Business for Potential Investors Investment Valuation Services Most Investors care about your discounted cash flow or DCF Why Value a Business When Seeking Investment Opportunities As a symbiotic and mutually productive relationship, businesses and investors have much to offer each other. A harmonious relationship between business and investor creates a healthy financial situation […]

How a Quality of Earnings Report Enhances Financial Clarity

What is a Quality of Earnings Analysis? What can a quality of earnings report reveal about a company’s true financial health? Designed to offer a clear picture, it sifts through earnings to highlight sustainable and achievable earnings, free from accounting distortions or non-recurring events. This article will guide you through the critical role these reports […]

Mastering Going Concern Value: Essential Insights for Business Valuation

Going Concern Business Valuation Methods Going concern value reflects a business’s worth, assuming it continues operations indefinitely. It factors in both tangible assets and intangible elements like brand reputation and customer relationships. Understanding this concept is essential for accurate business valuation. This article explores the going concern value, its importance, and the methods used to […]

Navigating Interest Rates and Business Value for Success

Interest rate effects on valuation multiples How do interest rates and business value impact each other? Understanding this can help you make better investment decisions. This article explains the key effects of interest rates and business value on business valuation and offers strategies for navigating these changes. You can also read how inflation destroys business […]

How to Buy a Business

What you need to know before buying a small business or large company How to Sort through the Deal Flow of 100,000+ Businesses for Sale Buying an Existing Business Steps If you’re considering buying an existing business, you’re not alone. Buying a business can be a great way to start entrepreneurship or expand your existing […]

Top Tips for Selling Shares in a Private Company

How to sell a minority interest in private company stock Are you looking to sell shares in a private company? It can be complicated, but we’re here to help sell shares in a private company. This guide walks you through understanding private company shares, different selling methods, and overcoming potential challenges. By the end, you’ll […]