Understanding Compound Interest The Rule of 72 estimates how long it will take for an investment or a debt to double in value at a fixed annual rate of return. By dividing 72 by your annual interest rate, you get the approximate number of years required. This quick mental math trick is valuable for making […]

Estate Planning

Business Valuations for Estate Planning

Welcome to our blog, where we discuss the world of business valuations for estate planning. Whether you're a business owner looking to pass on your legacy or an individual planning your financial future, understanding the value of your business is crucial.

Business valuation for estate planning, wealth transfer, and IRS gifting

In this blog, we will explore the intricacies of business valuations and how they play a vital role in estate planning. We will discuss the various methods used to determine the worth of a business, such as the income approach, market approach, and asset approach.

Factors that Impact a Business's Value

We will also cover the factors that can impact the value of a business, including financial performance, industry trends, and market conditions. Understanding these factors will help you make informed decisions when it comes to estate planning and ensure that your business is accurately valued.

Additionally, we will provide insights into the importance of regularly updating your business valuation to account for changes in your industry, ownership structure, or economic landscape. This will help you stay on top of your financial planning and make adjustments as needed.

Business Appraisal for Estate and Trust Planning

Throughout our blog, we will share practical tips and strategies for maximizing the value of your business, whether it's through growth initiatives, operational improvements, or strategic partnerships. We will also discuss the potential tax implications of business valuations in estate planning, helping you navigate this complex area with confidence.

Our aim is to demystify the world of business valuations for estate planning and provide you with the knowledge and tools to make informed decisions. We invite you to join us on this journey as we explore the ins and outs of business valuations and help you secure your financial future.

Stay tuned for our upcoming posts, where we will dive deeper into specific topics related to business valuations for estate planning. If you have any questions or specific areas you'd like us to cover, feel free to reach out. We're here to help you navigate the complexities of business valuations and estate planning with ease.

Navigating Tax Considerations When Selling a Business

How to avoid capital gains tax when selling a business Tax Implications of Selling a Business Understanding the key tax considerations is crucial to maximizing your profit when selling a business. This guide will outline the major tax implications you need to be aware of, such as capital gains taxes, options for structuring the sale, […]

How Much Should I Sell My Company For?

A Practical Guide to Business Valuation Are you wondering, ‘How much should I sell my company for?’ Key factors include profits, assets, cash flow, growth prospects, and market trends. This guide will help you understand these elements and outline practical steps to assess your business’s value accurately. Please read about obtaining a business valuation before […]

Top Strategies for Valuing a Construction Company in 2025

Construction Businesses Valuations Valuing a construction company is essential for owners looking to sell, investors aiming to purchase, or stakeholders making strategic decisions. This article covers the fundamental valuation methods, the importance of financial statements, market conditions, and operational efficiency. You’ll learn how to use different valuation approaches and what key factors to consider for […]

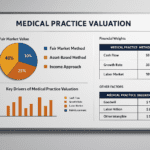

Mastering Medical Practice Valuation: Essential Tips and Techniques

Valuing a Medical Practice Medical practice valuation is critical for selling, buying, or managing a practice. This guide explores valuation methods, financial metrics, and factors that impact a practice’s value. Understanding your practice’s value is crucial for informed decision-making regarding future actions such as selling or merging. Key Takeaways Understanding Medical Practice Valuation Medical practice […]

Important 8283 Valuation Guidelines for Noncash Charitable Donations

A Certified 8283 Business Appraisal for the IRS Income Tax Return Donating or transferring non-cash assets via IRS tax form 8283 When giving non-cash assets, Form 8283 is your critical companion for business valuation and IRS reporting. Why does it matter? Accurate 8283 business valuation ensures you claim the right tax deductions without inviting audits […]

Top Exit Strategy Consultant: Top Tips for Business Growth

An exit strategy is vital for any business. It outlines how the owner will exit the business smoothly and profitably. Whether you plan to sell your business, transfer it to family, or pursue other options, a well-thought-out exit strategy ensures you maximize value and minimize risks. This article will explore essential tips and key components […]

Selling a Business? Here’s What to Know About Taxes

Know the Tax Implications Before You Sell Your Company Understanding the tax implications when selling a business is crucial. Taxes can significantly impact your profit and financial outcome. This article will guide you through the critical tax considerations, from capital gains to depreciation recapture, and help you plan effectively for a smooth transition. Key Takeaways […]

Florida’s Business Valuations Rise in 2025 Amid Strong Economic and Population Growth

Florida’s Business Valuations Rise in 2025 Amid Strong Economic and Population Growth By Chris Curtin & Lew Koflowitz Florida’s business landscape is experiencing a significant business valuations rise in 2025. This positive shift presents both opportunities and challenges for business owners, investors, and policymakers aiming to navigate the evolving market dynamics. To learn more about […]

How Much Should a Business Valuation Cost?

How Much Should I Spend on a Business Appraisal? How Much Does Business Valuation Services or a Business Appraisal Cost? What Should I Pay for a Business Valuation? How much does a business valuation or appraisal cost? Pricing to value a company varies from $2,900 to $9,700 for most business owners. How do you decide […]

The Important Role of Business Valuation in Exit Planning

Business owners frequently ask themselves and their trusted advisers if they need to spend money on a preliminary and independent business valuation as part of their exit strategy and whether it is a worthwhile investment. The answer is a big yes. Business Exit Planning It is critical to understand a business’ value. The prospective five-year […]

Determine My Restaurant’s Value: Insights for Accurate Valuation

Certified Restaurant Valuation Are you looking to determine your restaurant’s value? Understanding your restaurant’s worth is essential to your estate planning and exit strategy. This guide explains its importance, key influencing factors, and valuation methods. If you are a buyer in the restaurant industry, remember that 60% of restaurant businesses fail in the first year, […]